Behind every digital transformation is a team of people who make it happen. This typically includes a C-suite sponsor backed up by talented individuals across a range of business units and functions. And there are also external providers, who bring skills and talents that can’t be found inside the organization. These are essential actors in any transformation. Companies that effectively manage support from their external technology vendors can move seamlessly from a legacy position to a forward-looking, digitally driven business. Those that don’t will quickly realize that a business cannot transform itself entirely from within.

A recent survey conducted by BCG and the University of Auckland indicates that at least 55% of companies are not satisfied with their digital change projects. And when these transformations hit snags, tech sourcing can be at the heart of the problem. Companies have a plethora of vendors to choose from, but many fail to pay sufficient attention to the nuances of sourcing. For example, the motivations, experience, and expertise of vendors vary greatly, as do their familiarity with the company and their preference for a transactional versus a partner relationship. Organizations must consider the vendor point of view as well as their own and assess how it aligns with the goals of the digital transformation.

To increase the odds of a successful program, companies must have a good strategy for partnering with vendors. Our research suggests that they should focus on five areas: the sourcing model, the sourcing strategy, vendor selection and contracting, vendor management, and implementation.

Sourcing Model

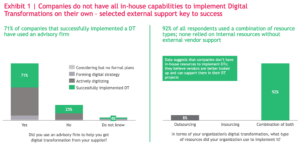

In our survey, most of the companies that enjoyed successful digital transformations used advisory firms and a combination of insourcing and outsourcing to execute their program. (See Exhibit 1.)

A full 92% of respondents said they had blended insourcing and outsourcing; 71% said they had used an advisory firm. In addition, these companies thought through their sourcing needs from the outset and had C-level executives leading the change project. In fact, 43% of respondents said that the CIO was the main driver of their transformation, followed by the CEO (33%) and the CTO (20%).

Clearly, a mix of teams is table stakes in an effective transformation. Not one company surveyed relied on internal resources without external vendor support. Digital transformations just don’t happen without vendor involvement. Therefore, choosing the right vendors is crucial, which is why advisory firms that research the market and select vendors for the initiative can be so helpful. Combining these different resources supports and enables the digital transformation.

One large company in the food and beverage industry noted that a blend of insourcing and outsourcing is especially optimal when the vendor strategy is developed at the start of the initiative. As the team built its strategy, they asked such questions as: What capabilities do we need and do we need them on our side or on the supplier side? Or do we want the arrangement to be more flexible and in-between? Indeed, the key question that emerged was: Do we need to insource or outsource, or do we perhaps need to co-source? Our own work with clients indicates that successful change projects require co-learning by both client and vendor, with each transforming its own operations and knowledge in the course of the digital transformation in a kind of reciprocal dependency.

Sourcing Strategy

There is no one-size-fits-all digital transformation strategy. For every situation, companies must think through the types of vendors they need and the deliverables they have in mind.

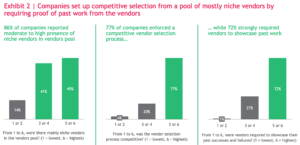

Our survey found that among successful companies, the use of niche vendors was relatively high (86%). Over 70% of these companies had implemented a competitive vendor selection process, while 72% required candidates to showcase past work. (See Exhibit 2.) A competitive selection process encourages vendors to present innovative and cost-efficient approaches and increases the odds of a positive outcome.

Successful companies also seek vendors that look at the entire business case and bring new ideas to the table. One company, however, reported concern about intellectual property, particularly when it comes to real innovations. Clearly the question of ownership must be addressed in the contracting stage.

In some transformations, longstanding relationships with vendors that know the business well can be quite beneficial. On the flip side, such partners may be too wedded to ways of doing business that will have to be changed or discarded. Companies must ask: Can the vendor adapt? Does it bring the right resources, outlook, and mindset to the change journey? If the answer is no, the company should move on. An international banking institution, for example, made the tough decision to shift from an incumbent partner to a niche vendor whose specialty and success with highly customized solutions were strongly aligned with the company’s focus on customers.

Vendor Selection and Contracting

Good relationships and open communication are central to high-performing outsourcing engagements. In a digital transformation, this means working with vendors that know the business well and establishing a clear and collaborative contracting process. In our survey, a majority of companies (77%) with successful change programs reported that they had selected incumbent IT vendors for their transformation initiatives, and 97% said they believed that the vendor executive team had a high level of involvement and therefore a deep commitment to the work. One large global vendor with 50,000 employees demonstrated its commitment to a banking institution client by making its board available to respond to concerns. “It helped to know that [the vendor’s] management was behind it,” said the bank’s top executive.

Successful vendor relationships stand on contracting frameworks that are unique to digital transformations and not borrowed from past (and potentially irrelevant) IT contracts. Respondents to our survey reported that they used detailed (72%) and digital transformation-specific (57%) contracts, while 75% said their vendors were involved in defining the scope of the project and the execution plan.

What makes a digital transformation contract unique and successful? One large company reported that the biggest shift in focus was from output to outcomes. As clients transform the way they expect value to be delivered by their partners, vendors must also adapt to agile ways of working, which require that they produce multiple iterations rather than a single final deliverable.

Vendor Management

Vendor experience with digital transformations ranked high in importance among our respondents, 72% of whom said they had asked candidate vendors to share their work history, while some 82% asked the vendors they hired to describe past successes and failures with change projects. Most respondents (95%) found vendors to be transparent with respect to failures, yet only 56% reported that vendors had provided extensive information about those failures.

Companies with adequate insight into the past experience of potential vendors will be much better equipped to develop a plan for working with the ones they ultimately select. The banking institution mentioned above learned this lesson all too well after its change project was underway. It was on the brink of severing ties with a vendor that was missing delivery deadlines and did not seem up to the task when the vendor admitted that the project was more complex than anticipated and it did not have the required skills. Fortunately, there was time to course-correct, and the teams were able to identify areas that needed to be staffed or upskilled.

Companies first get to know a vendor through the team involved in the pitching and contracting process. But when a different team comes in to execute the work, continuity is lost. Among our respondents, 73% reported that involvement by the vendor’s presale team in the transformation process was crucial in keeping teams working together efficiently. More than other elements of vendor management, this put the project on a stronger footing. And at 68% of the companies surveyed, the vendor’s presales team did stay on to execute the digital transformation.

Implementation

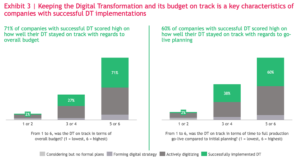

The outcome of a digital transformation depends on keeping the budget on track and holding vendors to task. In our survey, 71% of companies with successful initiatives reported staying on budget, indicating a correlation between good planning and a positive outcome. Indeed, at 60% of these companies, the project stayed on schedule and hit the agreed-upon launch date. (See Exhibit 3.)

Of course, sometimes things go wrong. When a project threatens to creep beyond scope or when vendors seem to be slipping on the timeline, leaders must be prepared to use the terms of the contract to keep things on track. In our survey, companies that successfully underwent a digital transformation invoked contractual obligations for nondelivery in 58% of cases; 67% included incentives in their contracts with vendors.

****

For most companies, vendor management will be central to successful digital transformation initiatives. Vendors bring expertise and fill gaps in in-house resources. A strong vendor strategy must be clear on the need to outsource and the ways in which vendors will best serve the project. And the company must conduct a competitive selection process, develop a working relationship with the vendors it selects that is rooted in an understanding of their past successes and failures, commit work output to a contractual agreement, and closely manage vendors to ensure that the project stays on budget and meets deadlines. Most companies can improve the results of their digital change project with the help of vendors— as long as an intentional sourcing strategy is set from the start.

About the Authors

Heiner Himmelreich is a partner and director in the Amsterdam and Melbourne offices of Boston Consulting Group. You may contact him by email at himmelreich.heiner@bcg.com.

Ilan Oshri is professor of technology and globalization at the University of Auckland Business School. You may contact him by email at ilan.oshri@auckland.ac.nz.

Acknowledgments

The authors acknowledge the support of BCG’s Julia Samson and of Renji John, formerly of BCG.

About Our Study

In 2019, BCG and the University of Auckland surveyed 107 executives at leading organizations in Europe and the US to identify key sourcing and planning strategies behind successful digital transformations. Roughly one-third of the respondents were based in the US, with the rest equally split among countries in Western Europe. The companies surveyed operate across the financial services, consumer goods, automotive, and health care sectors and have at least $250 million in revenues and at least 3,000 employees. Almost all respondents were in the later stages of their transformation or had completed their initiative. Almost all respondents (91%) were actively engaged in a digital transformation, 8% were in the planning stages, and 1% were considering a change project but had no formal plans. All the company representatives who responded to the survey were a level or two below the CEO but had authority over vendor management.